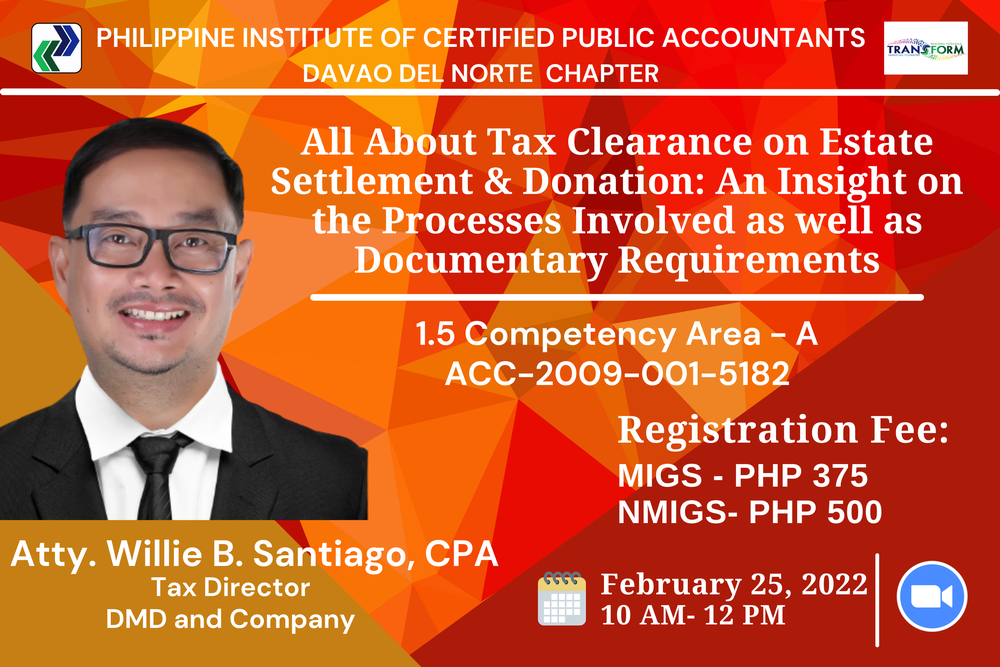

THE BIR PRESCRIBES NEW PROCESSES & ADMINISTRATIVE REQUIREMENTS ON ESTATE SETTLEMENT & DONATIONS BEFORE A TAX CLEARANCE IS ISSUED. IT IS IMPORTANT THAT THE ONE PROCESSING SHOULD HAVE FAMILIARITY WITH THESE NEW PROCESSES & ADMINISTRATIVE REQUIREMENTS TO ENSURE COMPLIANCE.

The objective of the program is to revisit some of the fundamental principles on the Laws on Succession & Donation,to know what the new requirements & administrative processes are in dealings with the BIR on matters involving tax clearance issuance on estate settlement, and to know what the new requirements & administrative processes are in dealings with the BIR on matters involving tax clearance issuance on donation.

Community

Connect with 46 people attending this event

PAYMENT OPTIONS

1. Via Over the Counter (OTC) Transaction: Cash/check deposit payment slip:

Deposit at: Any branch of PNB

Account Name: PICPA DAVAO DEL NORTE AND COMVAL CHAPTER

Account Number: 4013-7000-0911

NOTE: On the deposit slip, please indicate as REMARKS: COMPLETE NAME, email address and PRC ID number (if CPA)

When using this option to pay, please make sure you email a copy of your payment to: picpadavnorcomval@gmail.com at least three (3) days before the webinar conduct date to avoid inconveniences.

2. Through Online Banking or Mobile App or through G-Cash (App) Bank Transfer:

Payment for Company/Institution: PICPA DAVAO DEL NORTE AND

COMVAL CHAPTER

PNB (Recipient Account): 4013-7000-0911

Client Name: COMPLETE NAME of paying webinar participant

Reference Number: PRC ID number of paying PICPA member (if non-CPA, put N/A)

NOTE: When using this option to pay, please make sure you email a copy of your payment to:

picpadavnorcomval@gmail.com at least two (2) days before the webinar conduct date to avoid inconveniences.

3. GCash

Ivy Joy Cahayag- 09356443642

FOR OTHER CONCERNS AND FURTHER INQUIRIES

Ivy Joy Cahayag

Mobile #: 0948-223-5310

Email: picpadavaodelnorte@gmail.com